Total overunder applied variable overhead actual variable overhead- standard variable overhead cost applied to production 250000- 9500 units x 25 machine hoursunits x 10machine hour 250000 - 237500 12500 underapplied. If actual factory overhead is 95000 then underapplied overhead is 5000 95000 90000.

This Video Goes Over A Brief Review On Calculating Manufacturing Overhead And Then Goes In Depth On How To Dispose Of Over Appl Video Go Overhead Manufacturing

Prepare an income statement for a manufacturing firm.

. 3350 direct labor hours 6240 direct labor hours. For example if a companycalculates its predetermined overhead rate 6 per machine hour. For example if your company has 100000 in monthly manufacturing overhead and 600000 in monthly sales the overhead percentage would be about 17.

Calculate the cost of goods manufactured and cost of goods sold. The total overhead incurred is the total of. Direct labour 1805000Manufacturing overhead 902500.

Estimated may be close but is rarely accurate with what really happens so the result is Over-applied or Under-applied Overhead. Prepare the necessary journal entries for May assuming any over- or under-applied manufacturing overhead is written off to Cost of goods sold account monthly Materials inventory 5800. These over or under-applied overhead costs are common in manufacturing because.

Subtract the budgeted overhead costs from the actual overhead costs to determine the applied overhead. Is it over or under applied OH. OK Paste BIU- Alignment Number Cells Conditional Format as Cell Formatting Table Styles.

34560 F Overapplied Fixed Overhead U Underapplied Fixed Overhead. Click OK to begin. Assuming that over under applied overhead is insignificant or immaterial 5.

At the end of the year we will compare the applied overhead to the actual. Calculate the Cost of Goods Sold if over under applied overhead is immaterial. How do you calculate budgeted overhead.

The total overhead applied is 209040 which is calculated as. For example the actual overhead rate for a company is 10 an hour Therefore actual overhead is 10000 by the equation 10 x 1000 hours. How to Calculate the Over Under Applied Manufacturing Overhead Over or Under Explained.

If actual factory overhead is 95000 then underapplied overhead is 5000 95000 90000. We review their content and use your feedback to. Normal Occurrence in Overhead.

1 Calculate the over-applied or under-applied overhead for the year. Actual overhead costs may be different and we will not have all of those costs until late in the year. All answers must be entered as a formula.

It applies manufacturing overhead to production using a predetermined rate. Calculate and dispose of overapplied or underapplied manufacturing overhead. The balance in manufacturing overhead is a debit balance of 210.

To calculate the proportion of overhead costs compared to sales divide the monthly overhead cost by monthly sales and multiply by 100. Using the above information do the following. Calculate the companys predetermined overhead application rate.

Understanding over or under-applied manufacturing overhead is less complicated than it seems. If the situation is reverse and the company. The company charges any under- or over-applied overhead to the cost of goods sold category.

Applied overhead Actual manufacturing overhead Applied manufacturing overhead Therefore the over-applied overhead for the year is 56000. For example if a company calculates its predetermined overhead rate 6 per machine hour. Who are the experts.

Applied Overhead Formula Estimated Amount of Overhead Costs Estimated Activity of the Base Unit. Provide the journal entry that writes off overunder applied OH to CGS. For example a business with monthly sales of 100000 and overhead costs totaling 40000 has 40000 100000 x 100 40 overheads.

15000 machine hours are actually worked and overhead applied to production is therefore 90000 15000 hours 6. We know overhead is applied using estimated or budgeted overhead and a base. If the situation is reverse and the company applies 95000 and.

Compare to Labor Cost. Calculate the additions to the work-in-process inventory account for the direct material used direct labor and manufacturing overhead. The budget for 2020 was as follows.

Rice University Openstax CC BY SA 40. 33200 Budgeted Fixed Overhead. This overhead rate is set at the beginning of each fiscal year by forecasting the years overhead and relating It to direct labour costs.

1360 F Fixed Overhead Variance Applied Fixed Overhead. 15000machine hoursare actually worked and overhead applied to production is therefore 90000 15000 hours 6. To do this take your monthly overhead costs and divide it by your companys monthly sales.

Calculate over or under applied overhead for 202. Over- or underapplied fixed overhead for April. Then multiply it by 100.

Experts are tested by Chegg as specialists in their subject area.

29 Applied Manufacturing Overhead Png In 2021 How To Apply Cost Accounting Overhead

Definition Explanation Calculation And Causes Of Overapplied Overhead Get Answers To Overapplied Underapp Homework Help Managerial Accounting How To Apply

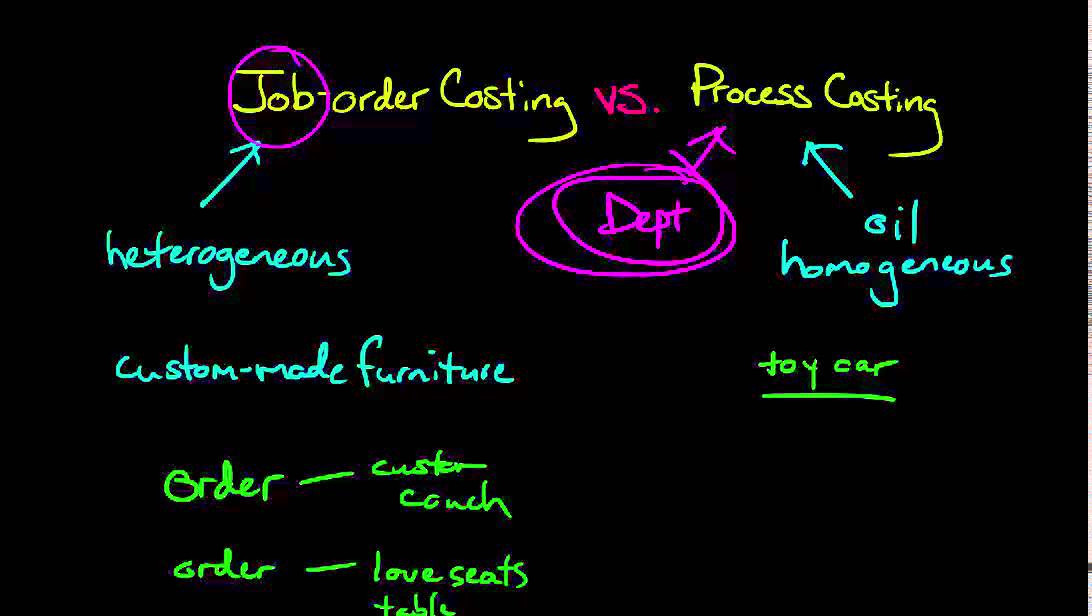

Tsedenya Gebreyesus In This Video He Explains And Goes Into Details About The Differences Of Job Order Costing And Process Costing He Job Relatable Process

0 Comments